#Copper etf plus

The Horizons BetaPro COMEX Copper Bull Plus ETF and the Horizons BetaPro COMEX Copper. “While past performance is not indicative of future performance, investors who have bought copper over the last six months have been well-rewarded, as it is generally viewed that the economic recovery in the emerging markets such as China has led to increases in demand for this metal, which is an essential commodity for industrialization and electronics manufacturing,” he explains. The Copper ETFs began trading on the Toronto Stock Exchange today. “In our view, using an ETF linked to the return of copper futures is the most direct and efficient way to invest in copper,” Atkinson says. dollar gains or losses as a result of the Copper ETF’s investment will be hedged back to the Canadian dollar to the best of its ability.Ītkinson points out that, outside of going directly to the futures markets, the only way investors can get access to copper through an ETF structure is indirectly through ETFs that track base metal equities. The ETF is denominated in Canadian dollars.Īny U.S. HUK seeks investment results, before fees, expenses, distributions, brokerage commissions and other transaction costs, that endeavour to correspond to the performance of the COMEX copper futures contract for a subsequent delivery month. With HUK we are expanding our ETF line up to give investors more choice to gain exposure to copper prices,” says Howard Atkinson, president of BetaPro. Since then, copper prices have reached record highs and global interest in this important metal has increased.

“Back in June of 2010, we launched the first leveraged copper futures ETFs in North America, listed on the TSX as HKU and HKD.

HUK is BetaPro’s third offering that offers investors the opportunity to gain exposure to market changes in copper futures contracts. Please check back soon or select from the following products. Given this, investors should tap the trend with ETFs like United States Copper Index Fund CPER, iPath. Horizons BetaPro COMEX Copper ETF began trading on the Toronto Stock Exchange Wednesday under the ticker symbol HUK. Sorry, this product is not yet available in your selected location. Surging copper prices will also provide a boost to miners, driving up the stock prices. has launched what it says is North America’s first non-leveraged exchange traded fund that offers exposure to the daily price performance of copper futures contracts. May 5, 2023: The respective Consolidated Reports combine their associated e-micro contracts S&P 500 (13874+), Nasdaq100 (20974+). I use the ETFS Copper ETF to invest in copper.BetaPro Management Inc.

#Copper etf series

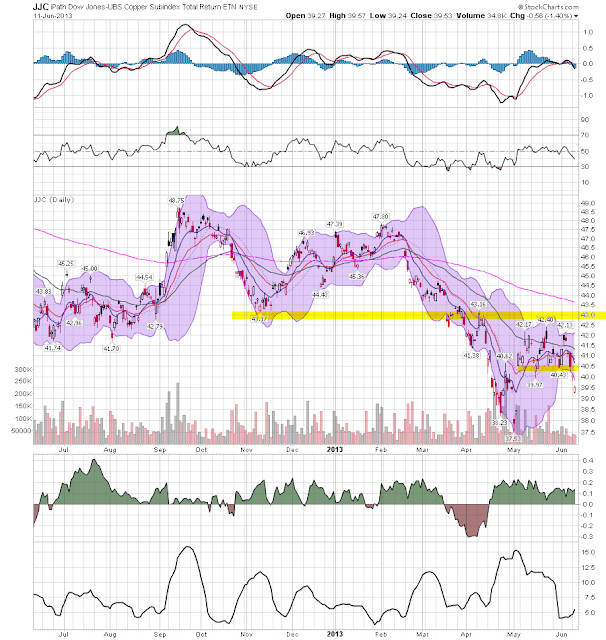

A return of 100% in only a few years is a realistic possibility for this copper ETF but of course prices move with the same cycles downwards. The two copper exchange-traded funds (ETFs), ranked by one-year trailing total returns, are the iPath Series B Bloomberg Copper Subindex Total Return ETN and the United States Copper Index. This cycle effect will repeat itself over and over again making way for investors to garner nice profits during these waves. When demand is rising so will supply and at the end we will be back at where we started. Inefficient mines will close and copper from recycling sources will not be put on the market.Įventually copper supply will be lower than demand and then the cycle turns itself around. When copper prices go down for some time, supply will follow too.

As with many basic materials prices are very cyclic. On the supply-side the copper mines are the dominating factor but we must not forget that copper is a highly recycled material so this has a large impact too.ĭemand is coming from industry.

#Copper etf drivers

Copper supply and demand are of course the drivers of the price of this copper ETF. As it is mainly used as a basic material for the production industry it is very depended upon the global economy. Copper is being used in many industrial practices.

0 kommentar(er)

0 kommentar(er)